A recent study, by EURid and the Leuven Statistics Research Centre, set out to better understand the most common usage of websites that are linked to domains, and we thought it would be an interesting exercise to extend similar analysis to the new generic top-level domain (gTLD) market. So, we analyzed all second-level domains registered in new gTLDs according to published zone files on June 29, 2014. Verisign utilizes our own proprietary process for classifying websites, which results in similar classifications to those by EURid. The primary difference is that the Verisign classification method is machine-based and is evaluated for each domain independently, while the EURid approach leveraged samples that humans classified.

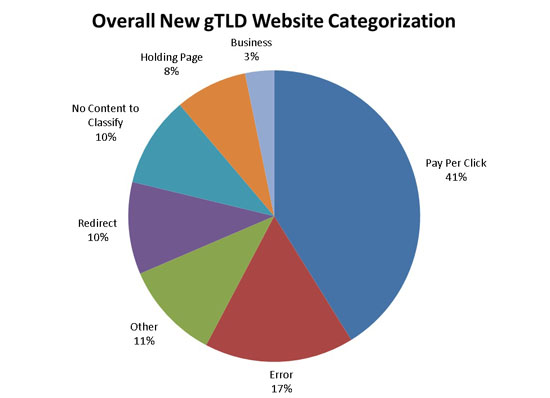

One key finding from our June 29, 2014, analysis is that 3 percent of domain names registered in new gTLDs contain business websites. In this case, we define “business” as a website that shows commercial activity, a definition that is slightly broader than EURid’s “business” classification which is defined as a website that clearly shows commercial activity and that is designed for customer interaction. EURid’s usage stat for 8 established TLDs found that 30.5 percent of domain names on these established gTLDs contained business websites.

Our analysis also found the most common use of domain names in the new gTLD space is Pay-Per-Click (PPC), with roughly 41 percent of all new gTLD domain names serving up PPC websites. A PPC website contains little user-generated content and almost exclusively advertising links.

The prevalence of PPC websites in the new gTLD space can likely be attributed to:

- Heightened speculation in the new gTLD space;

- The practice of several new gTLD registries to register their own domains which are still technically available at premium retail pricing, and several campaigns that provide domains from the new gTLDs at little or no cost to end users (some reportedly without their prior consent), and at least one campaign which automatically creates PPC websites on those provided domain names; and,

- The EURid approach classifies domains which immediately redirect or “forward” according to their ultimate destination. In contrast, the Verisign method for website classification identifies domains that forward to an alternative destination as a “Redirect.” The most notable change to augmenting the Verisign approach to classify domain usage according to the ultimate destination is an additional 2 percent of new gTLD registrations are linked to websites serving up PPC content.

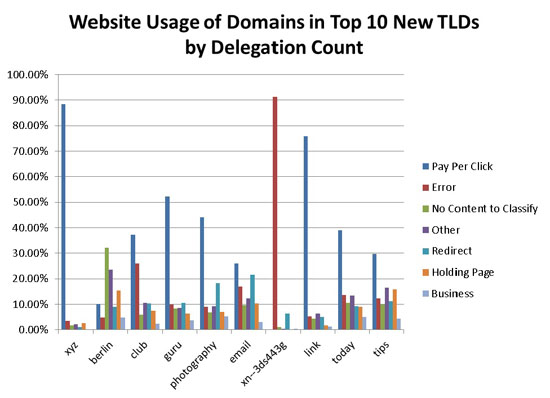

Finally, Verisign’s study also found that each of the new gTLDs have a personality of their own with very different usage distributions. Two such examples include:

- Dot Chinese Online (.在线/.xn—3ds443g) has 91 percent of the registered base serving up “Error” websites. This usage spike likely correlates with their unique distribution model, where they agreed to assign a significant portion of their new names to the Chinese central government. All of the names that are presumably part of that deal fail to return websites when users from the United States attempt to access them. The usage distribution of the remaining top 10 TLDs can be seen in Figure 2.

- XYZ.COM LLC (.xyz) has a high concentration of PPC websites as a result of a campaign that reportedly automatically registered XYZ domains to domain registrants in other TLDs unless they opted out of receiving the free domain name. After registration, these free names forward to a PPC site unless reconfigured by the end user registrant.

While it is still early days for new gTLDs, this analysis offers an interesting snapshot of the first few months of new gTLD general availability. It will be interesting to see how website usage evolves over the next year as more gTLDs become available for registration.